Terms of Payment and Cash Discount: Overview

What is the mean by Cash Discount?

Cash Discount is a reduction in the price of an item for sale, allowed in those cases when payment is made within a stipulated period. In a business scenario, the cash discount will always depend on the payment terms agreed with the customer with certain period of time. In every invoice the payment terms should be mentioned.

For Example we can say suppose if the payment term mentioned in the invoice is “5/25, Net 30”, this means that the customer is entitled to a 5% discount if the payment is made within 25 days of the delivery of goods. If the payment is being made beyond 25 days of the delivery of goods then full payment is expected. In any case, the full payment is expected to be made within 30 days.

Create a GL A/c of “Discount Allowed” under “Indirect Expenses” (FS00), Assign Field status group :G001

Follow the below mentioned path to configure “Terms of Payment” (OBB8)

Click on “Maintain Terms of Payment” ,The following screen Appears

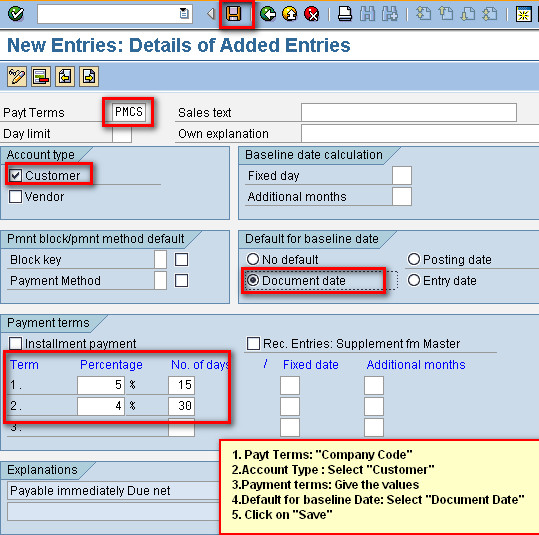

Click on “New Entries”, follow the next screen

Terms of payment has been created,

Now we need to configure for Cash Discount (OBXI) or Follow below mentioned path

In this step, you define the account numbers for your cash discount expense accounts. The system posts the cash discount amount to these accounts when clearing open items.

Note

Your specifications are dependent on the chart of accounts. You can additionally distinguish your specifications by tax code.

Activities

- 1. Specify your accounts.

- 2. Make sure that the accounts are created.

Chart of Accounts: “Company Code”

Click on “Accounts”

Click on “SAVE“

Now we need to “Modify Customer Master Data with Discount Term” (FD02)

- Select the “Customer”

- Click on “Company Code Data”

- Select “Payment Transactions”

- Terms of Payment : “Company Code”

- Click on “Save”.

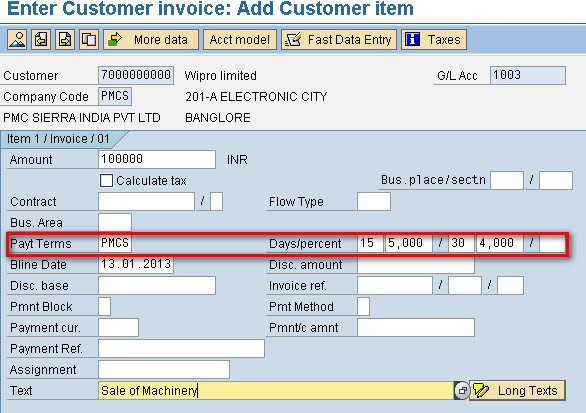

Raise Sales Invoice Under F-22

Retain the “Payment Term” to allow Discount or else delete the term not to allow the Discount

Post the entry.

Incoming Payment (F-28)

fill the data as mentioned above with full amount

Press”ENTER”

Click on “Charge of Diff” ,the following screen appears

Double click on Bank line item(HDFC Bank)

Amount: Modify Amount,100000*5%=5000

=100000-5000 =95000

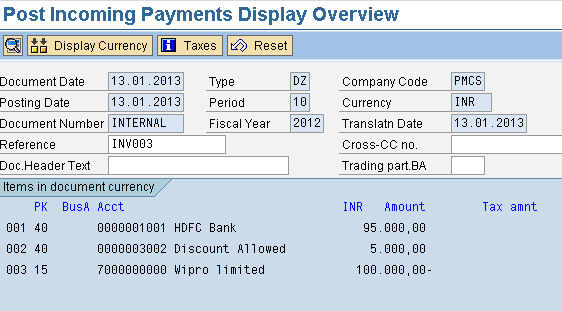

Click On Document & Simulate, Finale entry ll be

Also See: What is General Ledger Planning in SAP?